Meer bronnen

Perhaps one of the most confusing and challenging decisions to make in business is the pricing decision. Although pricing strategy can be a bit nerve wracking, the good news is that there are some established pricing methods available to help you. In this guide, we’ll talk you through how to optimize prices, and outline the top 5 pricing methods (and when to use them), putting you in the best possible position to get the most from your products, services and market.

Price optimization

Before we go into the specifics of the pricing decision, let’s start by thinking about how to optimize prices. Price optimization establishes the foundation for a sound pricing decision. Even armed with knowledge about what pricing methods are out there and how they’re used, you’ll still need to consider price optimization before settling on a pricing approach. Read on to learn about what we mean by price optimization and why it should be at the heart of your pricing strategy.

What is price optimization?

Price optimization is essentially a fact-finding process that you should follow in order to find the best possible price point for a product or service. The challenge of pricing is that it essentially involves a tradeoff. Low prices usually mean better value for the customer, which drives higher volumes of sales, but can represent a loss to you in terms of revenue that each individual sale brings in. Higher price points may mean that each sale represents higher overall profit, but if customers see the higher price as representing lower value for money, overall sales volumes will be lower. What price optimization does is help you to find that lucrative sweet spot between value and volumes, and that’s a precarious balance that can have a major impact on customer satisfaction, loyalty, sales, and ultimately— profitability and growth.

Sounds great, so how do you go about it? In fact, successful price optimization is far from an easy enterprise. It will require in-depth research of both your internal operations and your market. By combining market, business and consumer data, you’ll be able to answer questions like:

- What prices are our customers willing to pay?

- What kinds of discounts drive additional sales—and by how much?

- What prices suggest to our customers that our products are low quality?

- What prices suggest that our products are good value for money?

What information is used in price optimization?

Price optimization isn’t a game of trial and error. In order to get it right, you’ll need hard facts and data. The types of data you should think about gathering and incorporating into your analysis includes:

- Customer survey data. This is the best way to find out what customers are willing to pay, and to determine the linkages between willingness to pay at different price points, purchase frequency, likely customer churn, and the amount that customers will likely spend with you. Existing customers are an excellent source of information but it's important to glean insight from prospective customers as well. The types of survey questions you might ask include customers’ perceptions of your current pricing, their ideas about what constitutes value for money, and their likely reactions to loyalty programs, sales tactics, discounts, or promotions.

- Demographic/psychographic data. When gathering survey data, don’t forget to capture demographic and psychographic information like age, gender, household income and lifestyles. This will be crucial because different segments and categories of consumers will likely respond differently to different price points. Price optimization often means not just setting one price, but setting several.

- Historic sales data. If you’re already running your business, great news: you already have access to some very powerful data. Analysis of historical sales data can help you understand whether and the extent to which sales have changed in response to price changes.

- Operating costs. Profitable businesses need to cover their operating costs, so feed this information into your analysis too. This is especially the case if you’re using a cost-plus pricing strategy, or some kind of price designed to appear low in the minds of consumers, like penetration pricing or competitive pricing. More on that below.

- Inventories. It may not seem obvious but consider how many products or supplies you have in stock before you embark on your price optimization journey. Many companies have inadvertently undermined their reputations in the minds of consumers by heavily discounting prices, and driving heavy levels of sales, only to find that they quickly went out of stock, disappointing customers.

- Machine learning outputs. Some companies may find that they can use machine learning models to optimize prices. Machine learning can gather together and automate very large datasets in order to reach optimal prices quickly, efficiently, and with limited manual effort. Furthermore, machine learning models often take into consideration data that you might not have thought about using, such as weather patterns, seasonal changes and the occurrence of major events.

- Subscription lifetime value and churn data. If your business follows a subscription based model, don’t overlook the lifetime value of existing customers, as well as their churn rate. If you find that customers sign up and then quickly leave, you may find it is because prices are high compared to competitors, or that you need to lower prices in order to maximize subscription length, and hence customer value.

Introducing Momentive, an agile experience management company

Find out what your ideal price point is with a custom-designed price optimization study.

What you need to optimize for

So, what do you need to optimize for? In addition to your basic, everyday pricing, we recommend performing price optimization for:

Starting prices

The point at which your product first launches is vital to establishing it in the market and in the minds of customers. If you start with too low a price, you may gain some early traction, but you could lose sales in the long run as you begin to raise prices, as customers begin to think you no longer represent value for money. Alternatively, too high a starting price could cause you to miss out on sales from that lucrative innovator/early adopter segment of consumer.

Discounted prices

In order to drive sales, you might think a discount is the way forward. That’s often the case, but what level of discount should you offer? A 5% discount might be seen as measly by customers but could protect your bottom line. A 50% discount could be seen as a bonanza, but might undermine long term profit. Price optimization is a delicate process when it comes to discounts.

Promotional prices

Which is better: slashing prices to half of their original price, or offering a buy one get one free (BOGO) deal? On paper, both strategies have the potential to yield the same revenues, but practice and paper are very different beasts. Price optimization can help you determine the most effective and profitable approach to promotional prices.

Why is price optimization important

Price optimization is crucial for a myriad of reasons, all of which make a contribution to your bottom line:

- Non-existent price optimization can lead to problems, missed opportunities, and low revenue. Under- or over-pricing products and services are among some of the biggest causes of business failure and lack of profitability.

- Optimizing price is a high-impact growth lever. In contrast, if you optimize your prices, you’ll be best placed to grow quickly, because you’ll not only have the revenues to leverage growth, but you’ll also have a loyal customer base that you know is willing to pay the prices you set.

- Having a strong pricing strategy in place can help better meet customer expectations and convince them to buy. Failure to meet customers’ expectations is a surefire way to drive them to competitors. You can only meet customers’ needs if you understand what those needs are, and that includes the prices they expect from you.

- Pricing optimization will result in a repeatable process. Research to support price optimization can be complex, but once you’ve got the data, you’ll be able to replicate the analysis over and over again, saving you time and driving sales in the long run.

- Portrays value. Optimal prices are the best way to portray that your prices are value for money. For example, there is a fine line between what customers consider a bargain, and what they consider to be too cheap. It’s not worth trying to guesstimate where that sweet spot lies—use hard facts and data to help you.

Tips for price optimization

If you’re just starting out with optimizing prices, take into consideration the following tips and guidance.

- Get to know your customers. Price optimization is all about meeting customers’ needs and expectations. Offer a price that conveys value for money, and that customers are willing to pay (as well as a price that covers your costs!) and you’ve reached an optimal price. You’ll never be able to achieve that fine balance unless you get to know your customers. Send regular surveys, request feedback, and speak to them during and immediately after purchase to better understand if your prices have met their expectations.

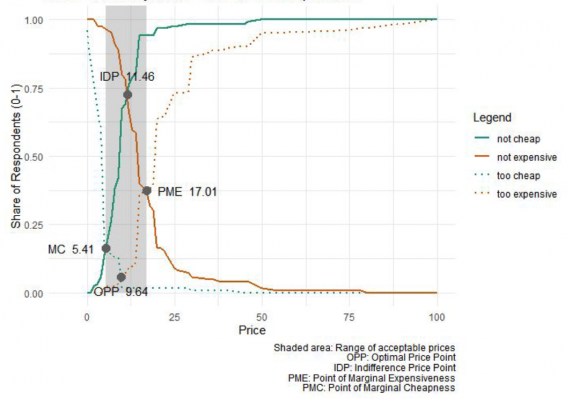

- Quantify value. What is value in the minds of your customer? This is actually a pretty difficult question to answer. The best way to answer this, of course, is to ask them directly. Using tools like the van Westendorp Price Sensitivity Meter, you’ll learn a lot about what customers consider to be too cheap, what they consider a bargain, and what they think represents value for money.

- Analyze data. Once you’ve gathered the data we’ve recommended above, analyze it—and then analyze it again! Customer demands, needs, expectations and their willingness to pay your prices are not static, and as a consequence, your pricing should be dynamic. For instance, if a hot new competitor enters the market, you’ll need to assess the impact of their prices on yours. Make it a habit to continually analyze data in order to make sure your pricing is always optimal. And, if you’re looking for a solution for help with this analysis—explore the Pricing Optimization solution by Momentive.

- Adjust pricing and monitor. After reviewing your data and adjusting your prices, make sure you monitor impact. Did that discount land effectively? Did that promotional sale help you acquire new customers, and how many? Price optimization is a long-term process so don’t forget to keep an eye on the consequences.

Supercharge your research program

Do you need full service market research? Or, would rather do research in-house? Either way, Momentive is here to supercharge your impact.

Top 5 pricing methods

Cost-plus pricing

Cost-plus pricing is one of the most popular approaches used in pricing. It involves calculating the cost of producing one unit of your product, and then adding a mark-up percentage. That is why you’ll sometimes see this method described as mark-up pricing. Cost-plus pricing is focused solely on the cost of producing your product or service (COGS) and the amount of profit you’re hoping to gain, rather than what customers are willing to pay, and pricing is not manipulated in a way to persuade or attract customers.

Advantages of cost-plus pricing

The main advantage of cost-plus pricing is its ease. You do not need to go through rounds and rounds of price testing: simply calculate your costs, add your mark-up and you’re good to go. Assuming that the price is affordable to customers, profit may be guaranteed, and stability is built into the pricing structure.

When to use cost-plus pricing

Cost-plus pricing is common both among manufacturers who want to cover their costs, and by retailers who sell physical products purchased from suppliers. This is because there is a guaranteed cost that needs to be covered by sales.

Competitive pricing

Competitive pricing is similar to penetration pricing in that the goal is to drive the target audience away from competitors and towards your brand. Using this approach, you’ll continually track competitor prices and then take appropriate steps to try to beat them out. Some businesses, especially retailers, even use price-matching as a strategy, either by constantly reviewing and adjusting prices in line with those of rivals, or by providing customers with a guarantee to refund the difference if they come across the same product or service at a lower price. As you might imagine, while this approach helps to make sure that your prices are in line with market averages and expectations, over the long-term, this can be hard to sustain.

Advantages of competitive pricing

- Can be useful if limiting production costs is one of your strengths. If you pride yourself on obtaining the most expensive raw materials, your products are handmade, or your costs cannot be controlled, competitive pricing is not for you because it could cut into your bottom line (that’s why Louis Vuitton leather goods are so expensive!). However, if you’re able to keep costs low, you can adopt a pricing strategy that tracks the market, rather than internal processes and costs.

- Will keep price-sensitive customers loyal to your brand for reliably helping them stay within budget. Customer loyalty is highly lucrative, and it is to your advantage to take steps to retain customers and convince them to return to you time and time again. If you know that your market consists of at least some price sensitive consumers, consider using a competitive pricing strategy to foster long-term, repeat customers.

When to use competitive pricing

Competitive pricing is best used in highly rivalrous or saturated markets, or where there is a lack of differentiation between your products and those of your competitors. If your product is on the shelves alongside competitors, and customers are unable to distinguish them, they’re likely to make their choice on the basis of prices. This is why goods like milk, bread, gas and other indistinguishable products are often priced competitively.

Value-based pricing

In today’s competitive and saturated markets, value pricing is arguably one of the most important pricing methods. This approach takes into account how beneficial, high-quality, and important your customers believe your products/services to be. In other words, it takes into account what your customers view as good value for money, and tries to match that value with an appropriate price. This strategy is often a core part of retailers’ promotional campaigns, as they seek to appeal to customers who place a high premium on getting bang for their buck.

Advantages of value pricing

The main advantage of this approach is that it can deliver high levels of customer satisfaction. Customers love getting value for money and are highly dissatisfied if they think they’re being ripped off. As long as your products and services meet customers expectations and deliver on the value proposition, value pricing can be the key to happy, loyal customers.

When to use value pricing

Value pricing can be used in a number of different scenarios and for products and services of different types. The most important thing is to make sure that you understand what value means in the minds of your buyers—and we can help you obtain that all important insight.

Price skimming

Price skimming is a medium to long term pricing strategy in which you launch a new product or service at a higher price point initially, gradually lowering the price over time. Let’s take a look at some of the benefits of this approach.

Advantages of price skimming

- Attracts early adopters. Imagine you’re bringing a new premium or highly innovative product to the market. Products like these have the potential to appeal to broader market segments, but your first task is to capture the interest of trendsetters or early adopters. Why? This important segment can influence others to buy because their decision to purchase essentially acts as a stamp of approval. Price skimming is an excellent way to attract these innovators (especially those with high incomes or willingness to spend high amounts) because the high price point signifies the product as innovative, novel or high in quality. Using this strategy, you can get the highest possible profit from these big spenders, and once demand among this segment is met, expand sales to more price sensitive customers.

- Can drive long-term sales. For highly appealing products or services, a price skimming strategy can drive long-term sales. That’s because the broader market, who may find the initial price unaffordable, will continue to keep an eye on the product and your marketing campaigns, waiting for prices to fall. If you combine a price skimming strategy with a carefully designed social media campaign, over the long-term, you’ll be able to convert passive followers into active purchasers.

- Provides financial security. If you’ ve invested considerably in the development of a new product or service, price skimming can provide you with a measure of security that your sunk costs will be covered. Provided that the initial price you choose isn’t too extreme, you can quickly recover your costs soon after launch using this approach.

When to use price skimming

There are two main scenarios in which a price skimming strategy should be considered.

For breakthrough products. If your product is the first to enter the marketplace, price skimming can be highly effective—and profitable. By selling your product or service at a higher initial price, you can generate the maximum profit in the shortest time possible, before competitors enter the market, and pricing pressures grow. The average price of products which were once novel but are now commonplace, such as Blu-ray and DVD players, has fallen over time because leading manufacturers followed a price skimming strategy.

For business to consumer (B2C) brands that rely on fast-moving trends. In retail, trends come and go quickly. So, it’s typically imperative to try to capture the majority of your sales while the trend is still hot, and before interest dwindles. Price skimming can help you maximize profitability at the top end of a trend.

Penetration pricing

Penetration pricing is essentially the opposite of price skimming: instead of starting with a high price that is gradually reduced, you enter the market with a low price, and steadily increase it as sales gain traction.

Advantages of penetration pricing

- It can drive customer loyalty. Customers who feel that they’re getting value for money can often be customers for life. A discounted experience often feels like a reward for customers, and if they know that your prices are regularly lower than your competitors’, they’re likely to hang around.

- Designed to put the spotlight on your brand. Low market prices are a great way to boost awareness and perceptions of your brand. If the price is very low, you can often acquire customers who might not ordinarily have considered buying from you. And, if you’re confident about the quality and appeal of your products and services, penetration prices are an excellent long-term customer acquisition strategy: customers will remain keen even once prices rise.

- You can gauge customer reactions to determine future prices. If you gather data on customer responses to your low prices, either through sales data, or more explicitly through surveys and similar, you’ll have some critical insight that you can use to make decisions about future prices. Once you’ve achieved market penetration, you can rise to an equivalent or high price depending on customer feedback.

When to use penetration pricing

While price skimming can help you to maximize profit margin in the early period of a product’s life cycle, penetration pricing actually increases the risk that you’ll make zero profit, or worse, some financial losses at the beginning of a sales period. So, why use this strategy? As the name might suggest, penetration pricing is best used to penetrate a new market. If you’re launching a new product or service, or pivoting to a new geographical location, penetration pricing can help you gain a foothold.

Custom pricing optimization services

That’s it in a nutshell: how to optimize prices and the top 5 pricing methods to help you do it. If you need help developing a pricing strategy based on market research, check out the pricing optimization solution by Momentive. Our custom market research services can also help you obtain the data you need to support your pricing decision.

Get started with your market research

Global survey panel

Collect market research data by sending your survey to a representative sample

Research services

Get help with your market research project by working with our expert research team

Expert solutions

Test creative or product concepts using an automated approach to analysis and reporting

To read more market research resources, visit our Sitemap.