Marktonderzoek: wat het is, hoe u het uitvoert en voorbeelden

Lees hoe u met marktonderzoek nieuwe markten opgaat, klanten tevreden houdt en nieuwe producten introduceert.

Met marktonderzoek krijgen bedrijven uitgebreide, op data gebaseerde inzichten in klanten, trends en concurrenten. Door marktonderzoek uit te voeren, kunnen bedrijven precies de gegevens verzamelen die ze nodig hebben om nieuwe markten te betreden, hun klanten tevreden te stellen en vol vertrouwen nieuwe producten te introduceren.

Dit is met name belangrijk gezien het feit dat meer dan 70% van alle nieuwe producten voor alledaags gebruik het niet redden na de introductie. Marktonderzoek in een vroeg stadium verkleint dit risico aanzienlijk en vergroot het succes, omdat u de strategie van uw bedrijf afstemt op de behoeften van klanten.

Succesvolle bedrijfsactiviteiten beginnen met effectief marktonderzoek.

Wat is marktonderzoek?

Marktonderzoek is het proces waarbij informatie wordt verzameld over het gedrag van klanten, voorkeuren, trends in de categorie en informatie over concurrenten.

Organisaties voeren doorgaans marktonderzoek uit voor een gerichte productontwikkeling en marktintroductiestrategie, en uiteindelijk om de bedrijfsgroei te stimuleren. Met de resultaten van marktonderzoek kunt u duidelijk zien hoe u inspeelt op de wensen van klanten. Ook weet u hoe u producten lanceert en de winst verhoogt.

Typen marktonderzoek

Marktonderzoek heeft vele gezichten. Marktonderzoek is eigenlijk een overkoepelende term voor verschillende soorten onderzoek, waarmee u een schat aan gegevens en bewijsmateriaal verzamelt om vol vertrouwen zakelijke beslissingen te nemen.

- Bij primair onderzoek, of eerstehands onderzoek, verzamelt u oorspronkelijke gegevens die een specifieke onderzoeksvraag beantwoorden.

- Bij secundair onderzoek analyseert u bestaande gegevens die door anderen zijn gepubliceerd om uw vraag te beantwoorden.

Het is belangrijk dat u goede kennis heeft van beide soorten marktonderzoek, onderzoeksmethoden en hun betreffende toepassingen, zodat u een marktonderzoek kunt opstellen dat uw zakelijke kwestie effectief aanpakt.

Primair onderzoek

Primair onderzoek is nuttig wanneer de kans zeer klein is dat een bedrijf openbare gegevens zal vinden over de onderzoeksvraag van het bedrijf. Dit is met name het geval wanneer een bedrijf onderzoek doet naar zijn eigen producten en services.

Hieronder staan enkele methoden die marktonderzoekers gebruiken:

- Enquêtes zijn een kwantitatieve methode om informatie te verzamelen bij een grote groep respondenten door ze gestandaardiseerde vragen te stellen. Bedrijven krijgen inzicht in de klantvoorkeuren, hun koopgedrag, hun tevredenheid en de vraag op de markt. Enquêtes kunnen ook wat kwalitatieve gegevens verzamelen via open vragen.

- Interviews zijn een-op-een-gesprekken die inzichten bieden in de drijfveren, percepties en besluitvormingsprocessen van individuele klanten. Tijdens diepte-interviews kunnen ingewikkelde onderwerpen grondig worden verkend die mogelijk in een groepssetting niet ter sprake komen.

- Focusgroepen zijn kleine groepen doelklanten waarmee een gespreksleider een gesprek voert. Tijdens deze gesprekken worden collectieve houdingen, meningen en reacties besproken op zakelijke ideeën, producten, diensten of marketingstrategieën.

- Online marktonderzoek, zoals online analyses, luisteren op sociale media en marktonderzoeksenquêtes, verzamelt data in real time over klantengedrag, markttrends en de concurrentiepositie.

- Met producttests kunnen potentiële klanten een product gebruiken in beheerde of echte omstandigheden. Via producttests vindt u eventuele problemen met de bruikbaarheid van het product, meet u hoe tevreden klanten zijn en stemt u uw aanbod af voordat al uw producten in de schappen liggen.

Secundair onderzoek

Bedrijven vinden secundair marktonderzoek nuttig als ze algemeen onderzoek willen uitvoeren over een onderwerp waarnaar al onderzoek is gedaan. Bredere onderzoeksvragen hebben meestal al gepubliceerde antwoorden.

Een paar voorbeelden van methoden voor secundair marktonderzoek:

- Brancherapporten worden opgesteld door onderzoeksbureaus, brancheorganisaties of adviesbureaus. De rapporten bevatten gedetailleerde inzichten over de marktomvang, groeitrends, belangrijke spelers en toekomstige ontwikkelingen. Met deze rapporten kunnen bedrijven hun prestaties vergelijken, nieuwe kansen vinden en onderbouwde strategische beslissingen nemen.

- Een concurrentieanalyse is een systematische beoordeling van de sterke en zwakke kanten van directe en indirecte concurrenten. Via deze analyse kunnen bedrijven gaten in de markt vinden, zich effectiever onderscheiden en inspelen op beslissingen van concurrenten.

- Overheidspublicaties bestaan uit economische indicatoren, demografische statistieken, handelsgegevens en regelgevende informatie. Deze publicaties bieden betrouwbare, meestal gratis hulpbronnen om veronderstellingen over markten te valideren en naleving met wettelijke en branchenormen te garanderen.

Marktonderzoek uitvoeren: een stapsgewijze handleiding

Marktonderzoek is een genuanceerd proces waarbij u vooruit moet denken en plannen. Als u het onderzoek in kaart brengt, kunt u met succes een initiatief starten, inzichten verzamelen en gegevens omzetten in bruikbare stappen voor uw organisatie.

Volg deze stappen bij het uitvoeren van marktonderzoek.

Stap 1: Onderzoeksdoelstellingen vastleggen

De onderzoeksvraag en bijbehorende doelstelling scherpen uw onderzoek aan en definiëren alle facetten, van gegevensverzameling tot de analysemethode.

Een bedrijfsvraag is een beknopte samenvatting van het probleem dat u oplost en de context binnen uw bedrijf. Het zijn algemene doelen of uitdagingen die rechtstreeks in verband staan met de doelstellingen van het bedrijf. Bijvoorbeeld: ‘Waarom daalt de omzet?’

Het onderzoeksdoel is een overzicht van de specifieke feiten of meetcriteria die u hoopt te ontdekken met uw onderzoek. Een onderzoeksdoel is bijvoorbeeld het meten van de merkbekendheid om de impact op de omzet te kennen.

Het schrijven van effectieve, relevante onderzoeksdoelen is belangrijk, omdat deze later worden vertaald in specifieke enquêtevragen. Hier zijn enkele hypothetische bedrijfsvragen en onderzoeksdoelen.

| Bedrijfsvraag | Onderzoeksdoel |

| Consumentengedrag: We overwegen te investeren in een aantal bedrijven die videostreamingdiensten aanbieden en we moeten het bestaande landschap en de bestaande percepties begrijpen zodat we verstandig kunnen investeren. | Ontdek welke technologiemerken en apps het populairst zijn onder millennials. Verzamel getuigenissen voor het aantal en de tevredenheid van de gebruikte apps. Krijg inzicht in het gebruik en de houding van millennials ten aanzien van streamingdiensten. |

| Advertenties testen: We staan op het punt om ons nieuwe hondenvoer op de markt te brengen. Onze ontwerpers hebben verschillende ontwerpen voor gedrukte advertenties ontwikkeld die allemaal even overtuigend zijn. Hoe kiezen we het ontwerp dat we willen gebruiken? | Vergelijk de aantrekkingskracht voor de consument en diens voorkeur voor elk advertentieontwerp. Identificeer voor welk ontwerp consumenten meer willen betalen. Evalueer eventuele verschillen op basis van de demografische gegevens van consumenten. |

| Brand tracking: We zijn een gevestigd merk in de categorie mineraalwater, maar het afgelopen jaar zijn er veel nieuwe merken geïntroduceerd. Wat betekent dat voor ons? | Meet de merkbekendheid voor alle grote merken in de categorie. Beoordeel de perceptie en associaties van elk merk. Krijg inzicht in merkacceptatie voor ons merk en de nieuwkomers. |

Stap 2: Uw doelgroep identificeren

Door uw doelgroep te identificeren voordat u marktonderzoek uitvoert, kunt u relevante, nauwkeurige gegevens verzamelen, uw aanpak afstemmen op de doelgroep, middelen optimaliseren en effectieve strategieën ontwikkelen.

Hiervoor moet u uw doelgroep begrijpen, waaronder de demografische gegevens, de arbeidsstatus, de firmografische gegevens, de winkelgewoonten en het gedrag.

Behalve uw doelgroep is het ook slim om het bereik te bepalen. Soms wilt u een grote doelgroep benaderen met verkennend onderzoek voor potentiële markten. En andere keren bent u op zoek naar een kleinere groep mensen om hun voorkeuren als consumenten te begrijpen.

Deze doelen hebben ook invloed op hoe u uw doelgroep bereikt. Twee degelijke opties zijn:

- Profiteren van uw bestaande contactpersonen, zoals uw klanten, websitebezoekers, abonnees op uw nieuwsbrief en volgers op sociale media. Populaire manieren om bestaande contactpersonen vragen te stellen, zijn via e-mail en sociale media. Ook kunt u de marketingenquête insluiten op uw website of een hyperlink of QR-code toevoegen aan een ontvangstbewijs.

- Als bedrijven ervoor kiezen vooraf geprofileerde targetingopties te gebruiken met tools zoals SurveyMonkey Audience, krijgen ze toegang tot een publiek van ruim 335 miljoen mensen en hebben ze geavanceerde opties voor targeting.

Stap 3: Uw onderzoeksmethode kiezen

De keuze van een onderzoeksmethode is een cruciale stap bij het ontwerpen en starten van marktonderzoek. Het type onderzoek dat u kiest (kwalitatief, kwantitatief of een combinatie) heeft een rechtstreekse invloed op de diepgang, betrouwbaarheid en toepasselijkheid van uw resultaten. Deze beslissing is dus essentieel voor het succes van uw project.

De juiste methode is afhankelijk van uw onderzoeksdoelstellingen.

- Kwalitatieve methoden, zoals interviews of focusgroepen, zijn vaak het effectiefst als u drijfveren of percepties van bestaande klanten wilt verkennen.

- Kwantitatieve tools, zoals enquêtes en online analyses, bieden gestructureerde, statistisch relevante data als u op schaal probeert gedrag, voorkeuren of trends te meten.

- Een secundaire gegevensanalyse kan ook een rol spelen, afhankelijk van uw middelen en gewenste inzichten.

Hoewel een of twee primaire methoden vaak het beste aansluiten op uw doelen, moet u niet denken dat onderzoek altijd een eenheidsworst is.

Door meerdere methoden in te zetten, zoals na de enquête grondige interviews uit te voeren, kunt u een genuanceerder en completer beeld van uw markt krijgen. Elke methode heeft unieke voordelen. Als u ze samen gebruikt, kunt u bevindingen valideren, bruikbare inzichten ontdekken en een betere, op bewijs gebaseerde strategie opbouwen.

Stap 4: Gegevens analyseren

Het verzamelen van data is nog maar het begin van marktonderzoek. De gegevensanalyse bestaat uit een systematisch onderzoek en een interpretatie van de data om patronen, trends en inzichten te vinden die de besluitvorming onderbouwen.

Begin met opgeruimde, complete gegevens

Voordat u de resultaten analyseert, moet uw dataset opgeschoond zijn. Verwijder reacties met een lage kwaliteit en wacht tot u alle reacties hebt ontvangen om vertekende resultaten te voorkomen (wegens de tijdzone of demografische verschillen). Check dat uw steekproef uw doelpopulatie nauwkeurig weerspiegelt. Is dat niet het geval, pas dan gewichten op de resultaten van uw enquête toe om een gebrekkige balans te corrigeren.

Controleer de statistische significantie

Bij het vergelijken van de resultaten (tussen demografische groepen of enquêtegolven), moeten de verschillen statistisch relevant zijn voordat u conclusies trekt.

Statistische significantie duidt erop of de antwoorden van een groep substantieel verschillen van die van een andere groep. Dit wordt vastgesteld via statistische tests. Is een verschil tussen steekproefgroepen statistisch significant, dan weet u zeker dat uw resultaten een echte eigenschap van de populatie afspiegelen in plaats van een willekeurige variatie in uw steekproef.

Een praktische vuistregel is om te controleren of de betrouwbaarheidsintervallen voor twee schattingen elkaar overlappen. Is dit niet het geval, dan is er waarschijnlijk sprake van een statistisch significante verandering.

De betrouwbaarheidsinterval wordt berekend door de foutmarge op te tellen bij, en af te trekken van een schatting. U kunt de foutmarge bepalen via een calculator voor de foutmarge of door de tabel hieronder als leidraad te gebruiken. In het algemeen wordt de foutmarge kleiner naarmate de steekproef groter wordt.

| Steekproefgrootte | Foutmarge (bij een betrouwbaarheidsniveau van 95%) |

| 50 | +/- 14% |

| 100 | +/- 10% |

| 150 | +/- 8% |

| 250 | +/- 6% |

| 400 | +/- 5% |

| 600 | +/- 4% |

| 1100 | +/- 3% |

| 2500 | +/- 2% |

Stel u stuurt 400 mensen een enquête en schat dat de merkbekendheid bij mannen 45% bedraagt en bij vrouwen 60%. Is de foutmarge ±5 procentpunten, dan is het betrouwbaarheidsniveau voor mannen 40% tot 50% en voor vrouwen 55% tot 65%. Omdat deze betrouwbaarheidsniveaus elkaar niet overlappen, is het verschil waarschijnlijk statistisch significant.

Houd trends met het verloop van tijd bij

Als u enquêtes gedurende langere perioden uitvoert (maandelijks, driemaandelijks of doorlopend), kunt u verschuivingen in klantgedrag, merkperceptie en marktdynamiek volgen en vergelijken. Zorg er wel voor dat u de targetingcriteria en de methodologie consequent toepast bij elke uitvoering. Alleen de timing mag veranderen.

Door trends langer te analyseren, samen met statistische consistentie, krijgt u betrouwbare inzichten die slimmere, op bewijs gebaseerde beslissingen bevorderen.

Stap 5: Uw bevindingen interpreteren

Wanneer u de resultaten van uw marktonderzoek ontvangt, kijkt u waarschijnlijk naar samengevoegde antwoorden uit de gehele steekproef. Bekijken hoe individuele segmenten van uw populatie reageren op uw marktonderzoek is één manier om inzichten te ontdekken die van cruciaal belang kunnen zijn voor uw analyse.

Hier ziet u een paar marktsegmenten van uw steekproef die u kunt onderzoeken:

- Demografische segmenten: gender, leeftijdsgroepen, enz.

- Geografische segmenten: landen, regio's, provincies, enz.

- Gedragssegmenten: frequente kopers van een categorie, kopers die met korting kopen, enz.

Ook zijn er twee manieren om uw resultaten te segmenteren voor inzichten die een stap verder gaan:

- Filter uw resultaten om te zien hoe specifieke segmenten hebben gereageerd.

- Vergelijk segmenten met elkaar of met de data in het algemeen om relevante verschillen te ontdekken.

Bij een enquête over de merkbekendheid van mineraalwater blijkt dat vrouwen consistent beter bekend zijn met het merk dan mannen. Dit verschil tussen genders kwam vooral tot uitdrukking bij merken zoals La Croix en Bubly, terwijl het kleiner uitviel bij merken zoals Schweppes.

Als u uw gegevens segmenteert, moet u altijd rekening houden met de groepen die hierdoor ontstaan. Als uw totale steekproef bijvoorbeeld 100 respondenten telt en u verdeelt de resultaten per provincie, dan hebt u maar een paar reacties per provincie. En dat is niet genoeg om betekenisvolle of betrouwbare conclusies te trekken.

Stap 6: Uw bevindingen rapporteren

De meest effectieve manier om een blijvende indruk te maken op uw belanghebbenden en hun aandacht vast te houden, is om een duidelijk, logisch verhaal te vertellen met uw data.

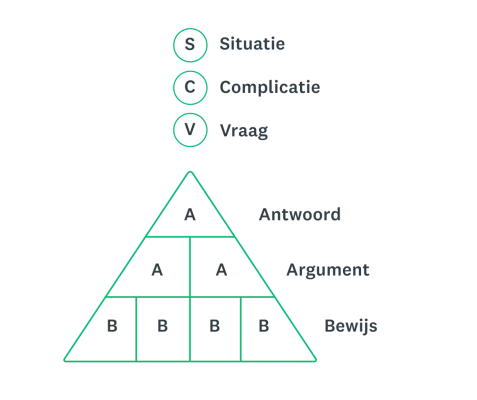

Vertel het verhaal zo dat belanghebbenden de context begrijpen voordat u uw bevindingen en aanbevelingen presenteert. Met een kader voor het verhaal, zoals SCQA, kunt u een contour voor uw presentatie opstellen.

SCQA staat voor Situation, Complication, Question, en Answer, oftewel Situatie, Complicatie, Vraag en Antwoord.

- Situatie: Huidige zakelijke context en bekende feiten.

- Complicatie: Het basisprobleem dat onderzocht moet worden.

- Vraag: De specifieke onderzoeksvragen en uw aanpak om ze te beantwoorden.

- Antwoord: Belangrijke inzichten die inspelen op de bedrijfsvragen en die acties in goede banen leiden.

Behalve het verhaal ondersteunen numerieke data uw businesscase, zodat belanghebbenden met tastbare data werken.

De beste statistieken ondersteunen uw claim met overtuigende cijfers. Als u namelijk de grens van 50% overstijgt, dan hebt u het over de meerderheid.

Als de gegevens die uw verhaal ondersteunen geen boeiende statistische gegevens opleveren, kunt u deze misschien in een nieuw kader plaatsen.

In plaats van ‘10% van de Nederlanders zou zich veilig voelen als passagier in een zelfrijdende auto’, kunt u ook zeggen ‘90% van de Nederlanders zou zich niet veilig voelen’. Als u een gestructureerde analyse uitvoert (bijv. het samenstellen van een scorekaart), dan werkt een nieuw kader voor statistieken niet.

U kunt uw claims verder onderbouwen door uw data te visualiseren.

Uit onderzoek van SurveyMonkey blijkt dat 42% van de mensen het prettiger vindt om gegevens gevisualiseerd te zien in diagrammen, grafieken of infographics dan gepresenteerd in een zin of tabel.

We geven u de meestgebruikte diagramtypen en wanneer u ze kunt gebruiken:

Stap 7: Actie ondernemen

Na het verzamelen van de gegevens, het analyseren van de cijfers en het opstellen van een actieplan, kunt u uw bevindingen presenteren aan de stakeholders. Het kan nogal een uitdaging zijn om anderen te overtuigen van uw aanbevelingen en ze te motiveren.

Als u uw belanghebbenden wilt overtuigen, maak uw aanbevelingen dan realistisch en stem ze af op de algehele bedrijfsstrategie. U kunt uw aanbevelingen baseren op het SMART-kader.

- Specifiek: De kans is kleiner dat belanghebbenden vage aanbevelingen uitvoeren. Uw aanbevelingen moeten specifieke, bruikbare stappen bevatten.

- Meetbaar: Koppel uw aanbevelingen aan kwantificeerbare bedrijfsresultaten of nog beter, voorspel de zakelijke impact als uw aanbevelingen worden geïmplementeerd. Door statistieken aan uw aanbevelingen toe te voegen, zelfs als deze zijn gebaseerd op aannamen, trekt u het management over de streep.

- Acceptabel: Zijn uw aanbevelingen niet realistisch, dan raakt u uw doelgroep kwijt. Zijn ze te veeleisend of vereisen ze meer middelen dan beschikbaar zijn, geef dan aan hoe uw aanbevelingen in de praktijk kunnen worden gebracht.

- Relevant: Begin door te verwijzen naar uw onderzoeksopdracht. Zorg dat uw aanbevelingen gebaseerd zijn op de initiële bedrijfsvraag en worden ondersteund door uw inzichten. En houd uw aanbevelingen gericht op de doelgroep waaraan u ze presenteert (zoals aanbevelingen over marketing aan het marketingteam).

- Tijdgebonden: Koppel uw aanbevelingen aan een duidelijke tijdlijn. Geef aan wanneer uw acties moeten beginnen, wat de belangrijke mijlpalen zijn en wanneer ze voltooid moeten worden. Een gedefinieerd tijdbestek creëert een gevoel van urgentie, vergroot de verantwoordelijkheid en maakt het mogelijk voor stakeholders om de implementatie effectief te plannen en prioriteren.

Voorbeeld van marktonderzoek

Marktonderzoek kan op allerlei onderdelen uw bedrijf voorbereiden op een datagestuurde toekomst. Een geweldig voorbeeld hiervan is Sakura of America.

Sakura heeft de oplossingen voor marktonderzoek van SurveyMonkey ingezet toen het bedrijf wilde onderzoeken hoe de Noord-Amerikaanse markt productontwikkeling en -ontwerp aanpakt. Sakura, dat gevestigd is in Japan, doet grotendeels origineel onderzoek naar de Japanse markt.

SurveyMonkey heeft gedetailleerde inzichten in de doelmarkt opgeleverd. Hierdoor kwam waardevolle informatie aan het licht over de marktomvang, het concurrentielandschap, de productpositionering en rechtstreekse klantenfeedback via SurveyMonkey.

Sakura heeft nieuwe onderzoeks- en ontwikkelingsinitiatieven ontdekt met het potentieel om succesvol te zijn op de Noord-Amerikaanse markt.

Effectieve onderzoeksenquêtes opbouwen met SurveyMonkey

Met marktonderzoek hoeft u niet meer te gissen. Iedereen, van klantervaringsspecialisten tot marketeers, kan met marktonderzoek vol vertrouwen op gegevens gebaseerde beslissingen nemen waarmee het bedrijf zijn doelen bereikt.

Gebruikt u SurveyMonkey, dan hoeft u geen marktonderzoeker te zijn. SurveyMonkey heeft uitgebreide ondersteuning en volledig beheerde oplossingen voor marktonderzoek, waaronder enquêtesjablonen voor marktonderzoek. Of u nu enquêtes over klantengedrag verzendt, namen voor uw bedrijf test of toegang wilt tot SurveyMonkey Audience, ons wereldwijde enquêtepanel, we hebben een oplossing voor u.

Klaar om aan de slag te gaan?

Meer hulpbronnen bekijken

Oplossingen voor uw functie

Met SurveyMonkey werkt u slimmer en beter. Ontdek hoe u meer impact maakt met winnende strategieën, producten, ervaringen en meer.

Ontdek hoe de Western Australian Police Union hervormingen doorvoert op basis van gegevens

Ontdek hoe de Western Australian Police Union inzichten van SurveyMonkey gebruikt om de rechten, belangen en het welzijn van de leden te beschermen.

Hornblower verbetert de ervaring van klanten wereldwijd

Ontdek hoe Hornblower met SurveyMonkey en krachtige AI het meeste uit zijn NPS-data haalt, klantinzichten verzamelt en de klantervaring verbetert.

Wat is agile marktonderzoek en hoe gebruikt u het?

Agile marktonderzoek verdeelt het onderzoeksproces in kleine, behapbare fasen, ook wel 'sprints' genoemd.