Marktonderzoek: definitie, belang en hoe u begint

Marktonderzoek is een strategie die zich allereerst baseert op gegevens om inzicht te krijgen in consumenten, stemmingen en markten in bredere zin. Leer stap voor stap hoe u effectief marktonderzoek kunt uitvoeren.

Marktonderzoek is een strategie die zich allereerst baseert op gegevens om inzicht te krijgen in consumenten, stemmingen en markten in bredere zin. Leer stap voor stap hoe u effectief marktonderzoek kunt uitvoeren.

Wat is marktonderzoek?

Marktonderzoek is het proces van het verzamelen van informatie en inzichten over de markt van een bedrijf, de concurrentie en de klanten. Organisaties voeren doorgaans marktonderzoek uit voor een gerichte productontwikkeling en marktintroductiestrategie en uiteindelijk om de bedrijfsgroei te stimuleren.

U beantwoordt er vragen mee als:

- Hoe groot zijn de marktkansen voor mijn product/service?

- Hoe doet ons merk het ten opzichte van de concurrentie?

- Bij welke demografische groepen is de kans het grootst dat zij mijn product of service kopen?

- Welke reclamecampagne resoneert het beste met mijn doelmarkt?

Met deze informatie hebt u een duidelijk pad om aan de eisen van klanten te voldoen, de winst te vergroten en producten op de markt te brengen.

Waarom is marktonderzoek belangrijk? 5 voordelen voor uw bedrijf

Marktonderzoek biedt het op gegevens gebaseerde bewijs waarmee u uw bedrijf kunt helpen om met vertrouwen beslissingen te nemen. In plaats van een bedrijf louter op basis van instinctieve beslissingen te bouwen, biedt marktonderzoek u direct inzicht in de wensen van uw doelgroep.

Waarom is marktonderzoek zo belangrijk:

- U leert de concurrentie te begrijpen. Met marktonderzoek kunt u onderzoek doen naar de succescriteria van uw concurrenten, hiaten in de strategie en trends. Met deze informatie kan uw bedrijf campagnes met grote impact opstellen, zodat u zich onderscheidt van uw concurrenten, interacties met klanten verbetert en potentiële klanten binnenhaalt.

- Maak betere producten en services. Met marktonderzoek kan een bedrijf gegevens verzamelen over het klantenbestand, waaronder inzicht in wat zij waarderen aan de producten en services. Met behulp van gegevens die zijn verzameld via klanttevredenheidsenquêtes kunt u voortborduren op feedback om uw producten, services en klanttevredenheid verder te verbeteren.

- Begrijp de voorkeuren en trends van klanten. Zo kunnen bedrijven effectievere marketingcampagnes creëren en de juiste innovaties doen.

- Verfijn uw marketingstrategieën. Het ontwerpen van een marketingstrategie en -product kost tijd en geld. Via marktonderzoek kunt u uw ideeën valideren, bevestigen dat u op de goede weg bent of de noodklok luiden.

- U komt geloofwaardig over. Of u nu overtuigend marketingmateriaal wilt creëren, een thought leader wilt worden in uw branche of indruk wilt maken op uw directie, marktonderzoek levert u de feiten om uw argumenten en beweringen te staven.

Typen marktonderzoek

Er zijn verschillende soorten marktonderzoek. We bespreken de meest voorkomende soorten, de voor- en nadelen en hoe ze worden gebruikt.

We behandelen de verschillen tussen:

- Primair marktonderzoek vs. secondair marktonderzoek

- Kwantitatief onderzoek vs. kwalitatief onderzoek

- Doe-het-zelf marktonderzoek vs. full-service marktonderzoek

Verder lezen: Definitie van marktonderzoek: typen en voorbeelden

Primair onderzoek vs. secondair onderzoek

In wezen kan marktonderzoek worden onderverdeeld in twee hoofdcategorieën: primair onderzoek en secundair onderzoek.

| Primair onderzoek | Secundair onderzoek | |

| Definitie | Er is sprake van primair marktonderzoek wanneer u oorspronkelijke gegevens verzamelt die antwoord geven op een specifieke onderzoeksvraag. | Bij secundair marktonderzoek analyseert u bestaande gegevens die door anderen zijn gepubliceerd om uw vraag te beantwoorden. |

| Praktijkvoorbeeld | Primair onderzoek is nuttig wanneer de kans zeer klein is dat een bedrijf openbare gegevens zal vinden over de onderzoeksvraag van het bedrijf. Dit is met name het geval wanneer een bedrijf onderzoek doet naar zijn eigen producten en services. | Bedrijven vinden secundair onderzoek nuttig als ze onderzoek op hoog niveau willen uitvoeren over een onderwerp waarnaar al onderzoek is gedaan. Bredere onderzoeksvragen hebben meestal al gepubliceerde antwoorden. |

| Voorbeeld | Een bedrijf wil weten hoe visueel aantrekkelijk hun nieuwe product is. Ze verzenden een marketingenquête om deze informatie te krijgen. | Een bedrijf wil weten wat de standaard demografische doelgroep is die te maken heeft met content in de sector van persoonlijke financiën. Ze zoeken naar gegevens over het onderwerp die al zijn gepubliceerd door instellingen voor persoonlijke financiën. |

| Voordelen | • Geeft rechtstreeks antwoord op uw onderzoeksvraag. • U hebt controle over de methodologie en aanpak. • U kunt vervolgvragen stellen om uw onderzoek verder uit te bouwen. | • U hebt directe toegang tot gegevens. • Vaak gratis toegankelijk. • Het kan instant context bieden voordat u uw eigen onderzoek gaat doen. |

| Nadelen | • Tijdrovend om uit te voeren. • Beperkte toegang tot steekproeven kan leiden tot vooringenomenheid. • Menselijke fouten kunnen van invloed zijn op uw resultaten. | • De gegevens zijn mogelijk verouderd. • Uw bedrijf heeft geen zeggenschap over het onderzoek. Er kan dus sprake zijn van vooringenomenheid of fouten. • Mogelijk hebt u geen directe toegang tot de gegevens. |

Verder lezen: Typen en voorbeelden van primair onderzoek

Kwantitatief onderzoek vs. kwalitatief onderzoek

Kwantitatief onderzoek en kwalitatief onderzoek zijn twee zijden van dezelfde munt. Met de eerste optie vindt u mogelijk een getal, zoals het totale percentage tevreden medewerkers in uw organisatie, en met de tweede methode komt u mogelijk achter het 'waarom' achter dit getal.

| Kwantitatief onderzoek | Kwalitatief onderzoek | |

| Definitie | Kwantitatief onderzoek is marktonderzoek waarbij numerieke gegevens worden gebruikt. Het is vaak gebaseerd op statistische analyse om numerieke resultaten op te leveren. | Kwalitatief onderzoek is marktonderzoek dat zich richt op het doorgronden van de motivaties, gevoelens, ideeën en meningen die achter de informatie liggen. |

| Praktijkvoorbeeld | Met kwantitatief onderzoek kunt u patronen of numeriek bewijs identificeren. | Kwalitatief onderzoek is nuttig als u de redenen achter een statistiek wilt begrijpen, waarbij in het onderzoek ook opmerkingen, ideeën en anekdotes worden meegenomen. |

| Voorbeeld | Een bedrijf wil inzicht in de loyaliteitspercentages van zijn medewerkers. Er wordt een eNPS-enquête gebruikt om het totale percentage trouwe werknemers in het bedrijf te berekenen. | Een bedrijf wil zijn lage eNPS-score begrijpen. Het bedrijf gebruikt enquêtes om werknemers te vragen naar hun mate van tevredenheid, problemen op de werkplek en suggesties om de werknemerservaring te verbeteren. |

| Voordelen | • Levert objectieve gegevens voor analyse en vergelijking. • Bedrijven kunnen op gedetailleerd niveau gegevenssets verkennen. • Geeft een duidelijk beeld van de relatie tussen statistieken. | • Openbaart de rijke informatie achter de numerieke gegevens. • Biedt context aan kwantitatieve gegevens. • Kan de oorzaak van sommige statistieken helpen begrijpen. |

| Nadelen | • Sommige zaken zijn moeilijk te kwantificeren. • Getallen kunnen verkeerd worden voorgesteld. • Misleidende vragen kunnen tot misleidende resultaten leiden. | • Het is subjectief, waardoor het moeilijk te analyseren is. • Door uiteenlopende interpretaties van stemming is het moeilijk om met kwalitatieve gegevens te werken. • Het opslaan en uitvoeren van analyses op kwalitatieve gegevens is een uitdaging. |

Onderzoekers kunnen kwantitatief en kwalitatief onderzoek individueel of in combinatie uitvoeren om bredere en diepere inzichten te verwerven.

Doe-het-zelf marktonderzoek versus full-service marktonderzoek

Een andere belangrijke factor voor verschillende vormen van onderzoek, is wie het onderzoek uitvoert.

| Doe-het-zelf marktonderzoek | Full-service marktonderzoek | |

| Definitie | Doe-het-zelf marktonderzoek houdt in dat een bedrijf zelf onderzoek verricht en eigen middelen gebruikt om onderzoek te doen. | Bij full-service marktonderzoek huurt een bedrijf een externe professionele onderzoeksgroep in om het onderzoek uit te voeren en het aan hen te presenteren. |

| Praktijkvoorbeeld | Doe-het-zelf marktonderzoek is handig voor bedrijven met een beperkt budget. | Full-service marktonderzoek is nuttig wanneer bedrijven behoefte hebben aan onderzoek van hoge kwaliteit, waarbij vaak complexe gegevens worden geanalyseerd. |

| Voorbeeld | Een bedrijf gebruikt zijn e-maillijst om een enquête per e-mail te verzenden om inzicht te krijgen in zijn klanten. | Een bedrijf voert een gedetailleerde telefoonenquête uit in de hele Verenigde Staten, waarbij tienduizenden gesprekken worden verzameld die worden gebruikt om de reactie op een nieuw productontwerp te testen. |

| Voordelen | • Voordelig. • Volledige controle over de vragen die u verstuurt. • U krijgt sneller resultaten. | • Hoge kwaliteitsnormen. • Biedt een hoge mate van nauwkeurigheid, onbevooroordeelde gegevensverzameling en uitgebreide details. • Toegang tot geavanceerde onderzoekssuites, hulpmiddelen en brede populaties die u kunt peilen. |

| Nadelen | • Het kan tijdrovend zijn. • Beperkte toegang tot bronnen. • Een gebrek aan interne expertise kan de resultaten beïnvloeden. | • Het kan duur zijn. • U hebt minder inzicht in het eigenlijke onderzoeksproces. • Het kan maanden duren om een project te voltooien. |

Marktonderzoek uitvoeren: een stapsgewijze handleiding

Marktonderzoek vereist een vooruitziende blik en enige geavanceerde planning. Als u het onderzoek in kaart brengt, kunt u met succes een initiatief starten, inzichten verzamelen en gegevens omzetten in bruikbare stappen voor uw organisatie.

Volg deze stappen bij het uitvoeren van marktonderzoek.

Stap 1: onderzoeksdoelstellingen vastleggen

Een volledig nieuw marktonderzoeksproject starten kan ontmoedigend zijn. Om gericht onderzoek te kunnen doen, moet u de bedrijfsvraag en de onderzoeksdoelen die u wilt bereiken uiteenzetten.

De bedrijfsvraag is een korte samenvatting van het probleem dat u aan het oplossen bent en de context van hoe dit binnen uw bedrijf past. Bedrijfsvragen zijn doelen of uitdagingen op hoog niveau die direct verband houden met bedrijfsdoelstellingen en waarmee u weloverwogen beslissingen kunt nemen.

Een bedrijfsvraag kan het volgende omvatten:

- Hiaten in de kennis: dingen die u niet weet over uw branche, de concurrentie of het kopersprofiel.

- Zakelijke fenomenen: trends die u ziet in het bedrijf (bijvoorbeeld: dalingen in de omzet of een stijging van het verloop) die uitleg behoeven.

- Voorspellingen: mogelijk wilt u de concurrentie een stap voor zijn.

Het onderzoeksdoel is een overzicht van de specifieke feiten of meetcriteria die u hoopt te ontdekken met uw onderzoek. Met andere woorden, uw onderzoeksdoelen helpen u bij het beantwoorden van uw bedrijfsvraag. U kunt onderzoeksdoelen aan deze vraag koppelen.

Het schrijven van sterke, relevante onderzoeksdoelen is belangrijk, omdat deze later worden vertaald in specifieke enquêtevragen.

Voorbeelden van onderzoeksdoelen en bedrijfsvragen in marktonderzoek

We geven u enkele hypothetische bedrijfsvragen en onderzoeksdoelen om te schetsen hoe effectieve onderzoeksdoelstellingen kunnen worden vastgesteld.

| Bedrijfsvraag | Onderzoeksdoel |

| Consumentengedrag: we overwegen te investeren in een aantal bedrijven die videostreamingdiensten aanbieden en we moeten het bestaande landschap en de bestaande percepties begrijpen zodat we verstandig kunnen investeren. | • Ontdek welke technologiemerken en apps het populairst zijn onder millennials. • Verzamel getuigenissen voor het aantal/de tevredenheid van de gebruikte apps. • Krijg inzicht in het gebruik en de houding van millennials ten aanzien van streamingdiensten. |

| Advertenties testen: we staan op het punt om ons nieuwe hondenvoer op de markt te brengen en onze ontwerpers hebben een aantal fantastische ontwerpen voor gedrukte advertenties bedacht. Hoe kiezen we een ontwerp? | • Vergelijk de aantrekkingskracht voor de consument en diens voorkeur voor elk advertentieontwerp. • Identificeer voor welk ontwerp consumenten meer willen betalen. • Evalueer eventuele verschillen naar demografische gegevens van consumenten. |

| Brand tracking: We zijn een gevestigd merk in de categorie mineraalwater, maar het afgelopen jaar zijn er veel nieuwe merken geïntroduceerd. Wat betekent dat voor ons? | • Meet de merkbekendheid voor alle grote merken in de categorie. • Beoordeel de perceptie en associaties van elk merk. • Verwerf inzicht in merkacceptatie voor ons merk en de nieuwkomers. |

Nadat u een bedrijfsvraag en onderzoeksdoel hebt vastgesteld, legt u deze vast in een onderzoeksopdracht.

Een goed geschreven onderzoeksopdracht vertelt iedereen die geïnteresseerd is precies wat u onderzoekt (en wat u niet onderzoekt), zodat alle neuzen dezelfde kant op staan.

Stap 2: uw doelgroep identificeren

Wanneer u marktonderzoek uitvoert, wilt u uiteindelijk inzicht krijgen in het gedrag en de percepties van de doelgroep waarin u bent geïnteresseerd.

Door uw doelgroep te identificeren voordat u marktonderzoek uitvoert, kunt u relevante, nauwkeurige gegevens verzamelen, uw aanpak afstemmen op de doelgroep, middelen optimaliseren en effectieve strategieën ontwikkelen.

We geven u enkele kenmerken waarmee u uw doelgroep kunt definiëren:

- Demografische gegevens: locatie, leeftijd, gender, opleiding, huishoudinkomen, ras, huwelijkse staat, ouderlijke status.

- Werkgelegenheid en bedrijfsgegevens: werkgelegenheidsstatus, functie, functieniveau, branche, bedrijfsgrootte.

- Winkelgewoonten: recentelijk bezochte winkels, frequentie van online winkelen, recentelijk bezochte restaurants, de kans dat in de komende 12 maanden een aankoop wordt gedaan.

- Gedragskenmerken: gebruik van mobiele apparaten/apps, huisdieren, trainingsfrequentie, dieetbeperkingen, hobby's.

Als u weet op wie u zich moet richten met uw marktonderzoek en hoe u dit wilt doen, heeft dit gevolgen voor de manier waarop u uw project van middelen voorziet.

Probeer de volgende vragen te beantwoorden voordat u aan de slag gaat:

- Bij wie voeren we marktonderzoek uit?

- Over hoeveel personen moet ik gegevens verzamelen?

- Heb ik al toegang tot deze personen?

- Kan ik snel genoeg reacties ontvangen van de personen die ik kan benaderen?

- Hoe kan ik de door mij gekozen onderzoeksmethode naar deze personen sturen?

Bij marktonderzoek wilt u zich soms richten op een breed publiek en soms op een gerichtere groep mensen.

Verder lezen: 5 soorten marktsegmentatie en hoe u ze kunt gebruiken

Uw doelgroep bereiken

De methode die u gebruikt om de mensen te bereiken van wie u gegevens wilt verzamelen, is afhankelijk van degenen met wie u contact wilt opnemen. U hebt twee opties: contact opnemen met uw bestaande contactpersonen of u richten op een specifieke groep mensen.

Als u contact opneemt met bestaande contactpersonen, richt u zich tot uw medewerkers, websitebezoekers of publiek op sociale media. Dit zijn de mensen tot wie u al toegang hebt.

In de meeste gevallen kunt u hen bereiken:

- Via e-mail.

- Door berichten op sociale media te plaatsen.

- Door een enquête in te sluiten op uw website.

- Door een hyperlink of QR-code toe te voegen aan een betalingsbewijs of marketingmateriaal.

Kies voor een specifieke groep mensen als u een doelmarkt in gedachten hebt waartoe u mogelijk geen directe toegang hebt.

Stel dat u een product hebt dat specifiek is bedoeld voor kleine honden. Mensen met huisdieren vormen een subset van de volwassen populatie, mensen met een hond vormen een subset van mensen met huisdieren en mensen met een kleine hond vormen een subset van alle mensen met een hond.

Er zijn twee manieren om u op een kleine populatie te richten: door te kiezen uit vooraf geprofileerde doelgroepen of door screeningsvragen te gebruiken.

Met SurveyMonkey Audience kunt u zich met geavanceerde doelgroepopties op vooraf geprofileerde doelgroepen uit 335 miljoen mensen richten. U kunt uw doelgroep selecteren op basis van:

- Demografische gegevens: leeftijd, gender, huishoudinkomen, enz.

- Bedrijfsgegevens: bedrijfstak, functie, functieniveau, enz.

- Gedragskenmerken: gebruikte apparaten, gedownloade apps, enz.

- Winkelgewoonten: mensen die voornamelijk in supermarkten winkelen, winkels waar gewinkeld is, enz.

Bekijk onze afstemmingsopties voor uw volgende marktonderzoeksproject.

U hebt de mogelijkheid om uw eigen screeningsvragen te gebruiken als u niet precies de gewenste doelgroep kunt vinden met de beschikbare afstemmingsopties.

U kunt beide methoden samen gebruiken. Specificeer bijvoorbeeld met behulp van afstemmingsopties mensen met een hond en sluit vervolgens met een screeningsvraag mensen met een grote hond uit.

Stap 3: uw onderzoeksmethode kiezen

Er zijn waarschijnlijk een of twee methoden die aansluiten op uw projectdoelen of u kunt zich op meerdere onderzoeksmethoden tegelijk concentreren.

1. Enquêtes

Het grootste voordeel van marktonderzoeksenquêtes is dat ze een van de snelste manieren zijn om gegevens te verzamelen. Bedrijven kunnen een e-mail met een koppeling naar hun klanten verzenden om ze de enquête te laten invullen, waardoor ze snel een grote hoeveelheid reacties kunnen verzamelen.

Bedrijven moeten zich echter bewust zijn van de kans op vooringenomenheid bij het maken van een enquête. Volg de aanbevolen procedures bij het schrijven van enquêtevragen om te voorkomen dat u uw doelgroep naar bepaalde antwoorden leidt.

Het verzenden van een reeks gesloten vragen helpt bij het statistisch analyseren van de reacties. Door het toevoegen van open vragen kunnen enquêtes alle aspecten dekken die u nodig hebt als u met marktonderzoek begint.

Ga aan de slag met marktonderzoeksenquêtes bij SurveyMonkey voor snelle, aanpasbare en vakkundig vervaardigde enquêtes.

2. Focusgroepen

Focusgroepen brengen een kleine en zorgvuldig geselecteerde groep individuen samen met vergelijkbare kenmerken.

Focusgroepen zijn de beste manier om diepgaande meningen, recensies, opmerkingen en ideeën met betrekking tot uw bedrijf te verzamelen. U kunt dieper ingaan op de motivaties van klanten of belangrijke informatie identificeren om u te helpen bij het oplossen van uw onderzoeksvraag.

Focusgroepen zijn echter vaak niet statistisch representatief en geven mogelijk niet de diversiteit van uw doelmarkt weer.

Verder lezen: Focusgroepen en enquêtes voor klant- en marktonderzoek

3. Interviews

Marktonderzoeksinterviews zijn persoonlijke gesprekken met klanten om diepgaande kwalitatieve informatie te verzamelen die betrekking heeft op uw onderzoek. Ze verschillen van focusgroepen door de mate van controle over de specifieke punten die tijdens het interview aan bod komen. Als interviewer kunt u vervolgvragen stellen om dingen beter te begrijpen.

Interviews zijn de beste keus als u zeer specifieke kwalitatieve gegevens moet verzamelen. Vooral als de kans klein is dat iemand gevoelens in een groep zal delen, is een interview een prima onderzoeksmethode om te gebruiken.

Het belangrijkste nadeel is dat ze ongelooflijk veel tijd in beslag kunnen nemen.

4. Openbare gegevens

Het gebruik van openbare gegevens voor marktonderzoek is een andere effectieve manier om snel gegevens te verzamelen.

Openbare gegevens vormen een kosteneffectieve en toegankelijke bron van gegevens voor uw marktonderzoek. De gegevens zijn ontleend aan overheidsbronnen of bekende bedrijven en zijn doorgaans goed gestructureerd, vrij van vooringenomenheid en nauwkeurig. U hebt echter geen invloed op de structuur.

5. Concurrentieanalyse

Een andere methode voor marktonderzoek die u kunt gebruiken, is een concurrentieanalyse. U kunt gedetailleerde informatie verzamelen over de services, actieve marketingcampagnes, huidige prijsmodellen, merkimago en doelgroep van concurrenten.

Hiermee kunt u inzichten verzamelen in vergelijkbare bedrijven binnen uw branche en vindt u misschien manieren om uw eigen bedrijf te onderscheiden.

De gegevens kunnen echter zeer beperkt zijn. Tools voor concurrentieanalyse zijn niet altijd nauwkeurig en het verzamelen van gegevens is tijdrovend.

Verder lezen: Een concurrentieanalyse uitvoeren met enquêtes

Stap 4: de gegevens analyseren

Nadat u de gegevens hebt verzameld, is het tijd om deze te analyseren.

Uw gegevens voorbereiden

Voordat u in uw resultaten duikt, zorgt u dat u met een complete, schone reeks gegevens werkt:

- Wacht tot alle resultaten zijn ontvangen voordat u begint met analyseren. Houd rekening met de tijdzone van uw doelgroep.

- Verwijder reacties van lage kwaliteit of spam.

- Voer nog een laatste controle uit om er zeker van te zijn dat uw steekproef uw doelgroep vertegenwoordigt.

Uw bevindingen interpreteren

Wanneer u de resultaten van uw marktonderzoek ontvangt, kijkt u waarschijnlijk naar samengevoegde antwoorden uit de gehele steekproef. Bekijken hoe individuele segmenten van uw populatie reageren op uw marktonderzoek is één manier om inzichten te ontdekken die van cruciaal belang kunnen zijn voor uw analyse.

Hier ziet u een paar segmenten van uw steekproef die u kunt onderzoeken:

- Demografische segmenten: gender, leeftijdsgroepen, enz.

- Geografische segmenten: landen, regio's, staten, enz.

- Gedragssegmenten: frequente kopers van een categorie, kopers die met korting kopen, enz.

Als u eenmaal weet welke segmenten interessant zijn om nader te bekijken, kunt u uw resultaten op twee manieren segmenteren voor diepere inzichten:

- Uw resultaten filteren: door uw gegevens te filteren, krijgt u inzicht in hoe een specifiek segment van een bredere populatie heeft gereageerd op uw onderzoeksenquêtes.

- Vergelijkingen maken: de voordelen van kijken naar afzonderlijke segmenten in uw resultaten worden groter als u deze vergelijkt met andere segmenten of uw gegevens als geheel.

Gegevenstrends in de loop der tijd analyseren

Het verzamelen van gegevens in de loop der tijd kan voor een bedrijf zeer nuttig zijn. Houd rekening met een aantal zaken bij het analyseren van gegevenstrends in de loop van de tijd:

- Inzicht in statistische significantie: het is normaal dat u in een tracker verschillen in resultaten tussen de verschillende golven ziet en onmiddellijk conclusies trekt, maar het is van cruciaal belang om te begrijpen of deze verschillen statistisch significant zijn voordat u een strategische beslissing neemt.

- Consistentie: zorg dat de doelcriteria, afstemming en andere steekproefspecificaties steeds hetzelfde blijven.

- Opsplitsing: als u werkt met een enquête die altijd actief is, moet u zorgen dat u uw tijdsperioden consequent opsplitst, dat wil zeggen in maanden, kwartalen, jaren.

Stap 5: uw bevindingen presenteren

Het vinden van een duidelijk, logisch verhaal in uw gegevens is de beste manier om indruk te maken en de aandacht te trekken van uw belanghebbenden.

We geven u zeven dingen om in gedachten te houden bij het opstellen van uw gegevensverhaal:

1. Stel uw verhaal op

U bent inmiddels vertrouwd geraakt met uw onderzoek. Maar dat geldt niet voor iedereen aan wie u de enquête wilt presenteren.

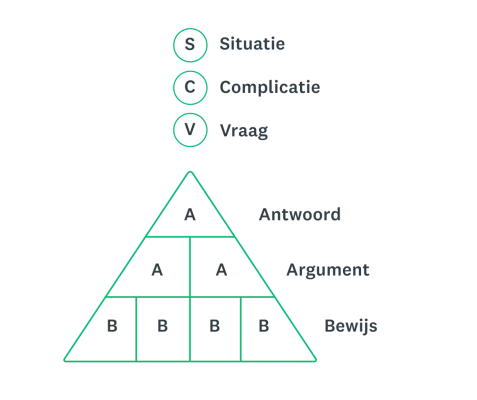

Met kaders voor het vertellen van verhalen kunt u een contour voor uw presentatie opstellen. Een kader dat u kunt volgen is SCQA: Situation (Situatie), Complication (Complicatie), Question (Vraag) en Answer (Antwoord).

- Situation (Situatie): waar het bedrijf zich vandaag de dag bevindt, wat de bekende gegevens zijn en eventuele andere relevante context.

- Complication (Complicatie): het zakelijke probleem dat moet worden opgelost, waarom u marktonderzoek bent gaan doen.

- Question (Vraag): welke specifieke vragen moeten worden beantwoord met uw onderzoek en hoe u deze kunt beantwoorden.

- Answer (Antwoord): de belangrijkste inzichten die uit uw marktonderzoek voortvloeien en uw bedrijfsvragen beantwoorden en hoe deze leiden tot actie om uw complicatie op te lossen.

2. Voeg zakelijke context toe

Gebruik bij de presentatie van uw onderzoek de zakelijke context om uit te leggen waarom het onderzoek nodig was. Als u het SCQA-voorbeeld volgt, is dit het onderdeel 'complicatie' van het verhaal.

Laat zien waarom uw onderzoek belangrijk is, waarom belanghebbenden het belangrijk zouden moeten vinden en hoe de bevindingen het bedrijf kunnen helpen.

3. Kies enkele krachtige statistieken

Kies uw statistiek met de meeste impact en gebruik deze om de aandacht van uw publiek te trekken.

Als de gegevens die uw verhaal ondersteunen geen boeiende statistische gegevens opleveren, kunt u deze misschien in een nieuw kader plaatsen. In plaats van "10% van de Nederlanders zou zich veilig voelen als passagier in een zelfrijdende auto”, kunt u ook zeggen “90% van de Nederlanders zou zich niet veilig voelen".

4. Focus op het 'waarom'

De objectieve cijfers vertellen u wat er is gebeurd, maar als u de stemmen en meningen van consumenten verzamelt met behulp van marktonderzoek, kunt u het 'waarom' blootleggen.

Neem even afstand en kijk of uw presentatie zowel de 'wat'- en 'hoe'-vraag als de 'waarom'-vraag beantwoordt.

5. Houd het simpel

U hebt veel onderzoek gedaan naar uw gegevens en hoewel veel van de bevindingen misschien interessant zijn, zijn ze misschien niet allemaal relevant voor uw verhaal. Neem alleen de bevindingen op die een bijdrage leveren aan uw verhaal en aanbevelingen of die een verrijking ervan vormen. Al het andere kan in een bijlage worden gezet.

6. Kies de juiste visualisatietechniek

Uit onderzoek van SurveyMonkey blijkt dat 42% van de mensen gegevens die zijn gevisualiseerd met diagrammen, grafieken of infographics prettiger vindt dan gegevens die in een zin of in een tabel worden gepresenteerd.

We geven u de meestgebruikte diagramtypen en wanneer u ze kunt gebruiken:

7. Maak het menselijk

Uiteindelijk is het doel van marktonderzoek het verklaren van menselijke percepties en gedragingen. Hoe meer echte voorbeelden u in uw verhaal kunt opnemen, des te tastbaarder de resultaten zullen zijn voor uw publiek.

U kunt dit bijvoorbeeld doen door veel citaten uit uw reacties op open vragen toe te voegen. U kunt ook kwalitatieve informatie (zoals interviews, klantondersteuningscases, enz.) combineren met uw kwantitatieve resultaten. Deze strategie brengt uw gegevens tot leven en maakt uw punten nog veel overtuigender.

Stap 6: tot actie aanzetten

De volgende twee strategieën werken goed als u belanghebbenden tot actie wilt aanzetten:

- Ga op tour met uw onderzoek: houd een reeks bijeenkomsten met alle belangrijke belanghebbenden om uw bevindingen en aanbevelingen te presenteren.

- Stel een follow-upplan op: houd uw belanghebbenden verantwoordelijk met follow-upbijeenkomsten en gedetailleerde projectplannen.

Als u uw belanghebbenden wilt overtuigen, maak uw aanbevelingen dan realistisch en stem ze af op de algehele bedrijfsstrategie.

- Gericht: begin door te verwijzen naar uw onderzoeksopdracht. Zorg dat uw aanbevelingen voortvloeien uit de initiële bedrijfsvraag en worden ondersteund door uw inzichten.

- Specifiek: zorg dat uw aanbevelingen een duidelijk overzicht geven van specifieke acties die moeten worden ondernomen.

- Haalbaar: communiceer dat uw plan haalbaar is door te schetsen wat er nodig zou zijn om uw aanbevelingen te verwezenlijken, met inbegrip van budget of personeel.

- Meetbaar: koppel uw aanbevelingen aan kwantificeerbare bedrijfsresultaten of voorspel de zakelijke impact als uw aanbevelingen worden geïmplementeerd.

Effectief marktonderzoek uitvoeren met SurveyMonkey

Nooit meer gokken als u overstapt op een volledig op gegevens gebaseerd systeem dat uw bedrijf brengt waar u het wilt hebben.

SurveyMonkey biedt uitgebreide ondersteuning en volledig beheerde oplossingen voor marktonderzoek. Of u nu marktonderzoeksenquêtes verstuurt of gebruikmaakt van SurveyMonkey Audience, ons wereldwijde enquêtepanel, wij hebben een oplossing voor u.

Klaar om aan de slag te gaan met marktonderzoek?

Meer hulpbronnen bekijken

Brand manager

Brand managers kunnen met deze toolkit hun doelgroep beter begrijpen, het merk laten groeien en het rendement aantonen.

Succesverhalen met SurveyMonkey van topmarketeers

Zie de marketinginzichten in actie met strategieën voor SurveyMonkey binnen marketing.

3 trends op de werkplek met impact op het personeelsbestand van de toekomst

Nieuw onderzoek over trends op de werkplek en hoe medewerkers privétijd, thuiswerken en de kloof tussen werken op afstand en op kantoor overbruggen

Succesvolle campagnes met de marketingmix 4 p's

Beheers de 4 p's – product, prijs, plaats en promotie – en ontdek hoe u deze kunt gebruiken om een marketingstrategie op te stellen die tot resultaten leidt.